On September 5, 1882, the Knights of Labor celebrated the first Labor Day in New York City’s Union Square.

The Knights of Labor

The Knights were an unusual organization for their day, eschewing radicalism and enrolling all segments of labor:

- from skilled to unskilled workers;

- from managers to sharecroppers; and

- including recent immigrants, African Americans, and women.

They only excluded “the unproductive members of society“: bankers, gamblers, lawyers, and liquor manufacturers.

They did not divide management and labor, as later movements did. The Knights deemed the true threat to a well-functioning business to be those that did not value their employees as human beings, the unscrupulous robber barons. They demanded that businesses allow employees their rightful voice at the decision-making table. (As well as for the government to prohibit exploitative and unsafe work conditions and child labor.)

The Knights kept their member list secret to prevent retaliation from the robber barons. For years, the robber barons used every economic and judicial tool to silence the voices of the employees. Within a decade, paramilitary action decimated the Knights of Labor in the aftermath of the Haymarket Affair and the Thibodaux massacre.

As other groups rose up to fill the void, they separated skilled and unskilled workers, management and factory workers. The hard-won rights that were finally enacted into law reflected this splintering. They protected factory-type workers, who represented only one side of the Knights of Labor coalition and excluded groups ranging from sharecroppers to managers.

The destructive short-term mentality of private equity

Today, technical innovation has made these protections obsolete. Everyone is a manager – of contractors and technology. Automation has enabled machines to take on some tasks, from automated teller machines to machine translation. The gig economy has allowed owners to rent out idle resources (their time, language expertise, cars and homes). Every service business is now a tech-enabled service business.

Venture capital firms, using the Giant Pool of Money at the center of the world economy, drove this disruptive, but value-creating innovation. But there is a darker side. Venture capital is only a small portion of the $100 trillion shadow banking system. This shadow system employs thousands to wring profits from this Giant Pool of Money rather than to create value. Endemic corruption (legal and illegal) ensures that this shadow system works hand in hand with the more regulated banking system.

As President Obama said, when the “priority is to maximize profits – that’s not always going to be good for businesses or communities or workers.” This corruption works by maximizing short-term, inflated profits at the expense of long-term profit derived from actual value. And it ensures that there are no losers among the banks and consulting agencies and lawyers. The only losers are among the businesses, communities, and employees who are in it for the long-term.

The key insight came to me when a friend working in finance told me that I kept thinking like an operator, rather than someone in finance. What he meant was that an operator tries to build a business – with products, processes, teams – that creates value and that sustains it.

But for someone in finance their profit is derived not from value created over time, but from proximity to an immediately profitable deal. To the wrong type of financier, people and customer loyalty are expendable things to be used and then discarded in return for a quick profit. (Footnote 1.)

The destructive cycle is inevitable:

Once the buyout is completed, the private equity guys start swinging the meat axe, aggressively cutting costs wherever they can – so that the company can start paying off its new debt – by laying off workers and cutting capital costs…

It takes several years before the impacts of this predatory activity – reduced customer service, inferior products – become fully apparent, but by that time the private equity firm has generally resold the business at a profit and moved on.

I’ve seen this play out in news stories. The leader in my own industry went through a dramatic restruring as it prepared to sell itself to private equity:

- pushing out many of it’s top innovators and the leaders who built the company’s value and brand; and

- outsourcing it’s production centers to lower cost centers as it cut costs.

This is the absolute opposite of the Value Investing that Warren Buffett advocates. It’s bad for the economy. It’s bad for most people. But it sure makes a killing for a handful of companies in the short-term.

The only sustainable competitive advantage

Last September in San Francisco, the co-CEO of my company told a group of clients:

In my 24 years as CEO, I have learned one big thing. All competitive advantages – price, quality, even technology – are commoditized over a long-enough time horizon. They only way to have a sustainable competitive advantage is people.

That is the type of company I want to work for; and today, it is the company I am proud to work for. I’m proud of the products my team has created, and the successes, both for clients and internally. I’m proud of the team for coming together again and again in the midst of adversity and distraction.

But our economy is filled with vultures; and it’s hard to turn down a quick profit, no matter the pangs of conscience. With barbarians at the gate, what are we to do? The Hollywood ending calls for Richard Gere to realize that he no longer wants to rip companies apart for short-term profits. Instead, he wants to help them build a better boats.

But in reality, greed outstrips morality most days of the week. But for this one day, in honor of Labor Day:

- we should all reflect on the company we work for;

- we should reflect on our position and the value we offer;

- we should look at whether we have a voice at the decision-making table today and in the future; and

- we should think about the type of society we want to live in, and whether our actions today are helping to create that society.

For if we don’t, we are destined to be mere cogs in a machine, waiting to be outsourced.

***

[Political posts have been…let’s say rarer from me. My professional page is now at JoeCampbell.me]

Footnote 1: A cartoon villain of an attorney once told me and a group of employees that private equity firms “could staff [the company I work for] in a week with people of…equal, if not superior talents.”

Why are we listening to the Bush administration officials anyway? They didn’t get Bin Laden. They’re like the Winklevoss Twins of getting Bin Laden. If you were the guys who were going to kill Bin Laden, you would have killed Bin Laden!

Why are we listening to the Bush administration officials anyway? They didn’t get Bin Laden. They’re like the Winklevoss Twins of getting Bin Laden. If you were the guys who were going to kill Bin Laden, you would have killed Bin Laden!

[reddit-me]

[reddit-me]

[reddit-me]I’ve started

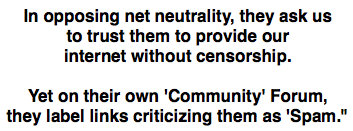

[reddit-me]I’ve started  government regulation, and the blocking of financing to prevent the disruptive technology from taking off.

government regulation, and the blocking of financing to prevent the disruptive technology from taking off.

forth a plan with no prospect of passing at all — and one that managed

forth a plan with no prospect of passing at all — and one that managed